7667766266

enquiry@shankarias.in

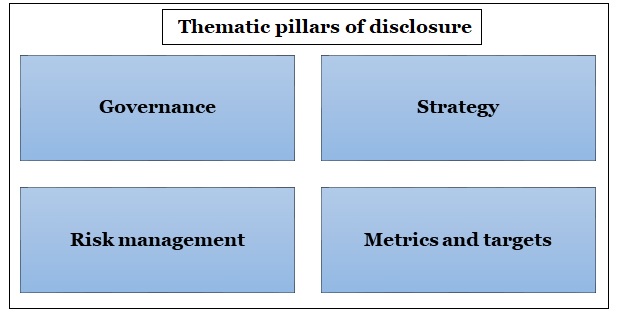

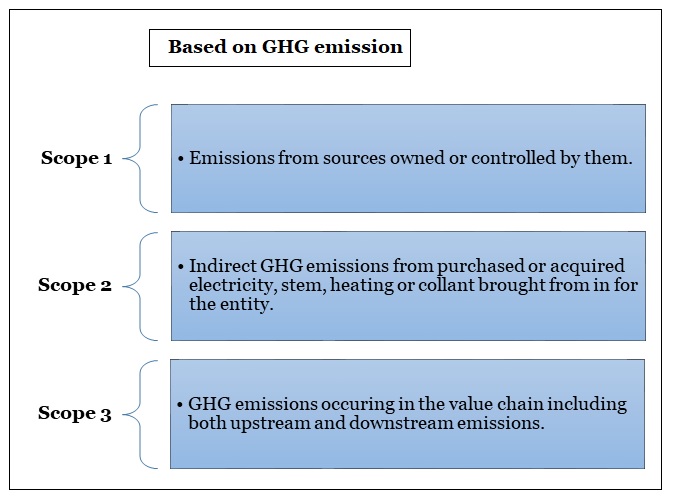

Recently Reserve Bank of India (RBI) has proposed a Disclosure framework on Climate-related Financial Risks, 2024 to address the financial risks associated with climate change.

|

Risk categorization |

|

|

Physical risks |

Transitional risks |

|

|

References