7667766266

enquiry@shankarias.in

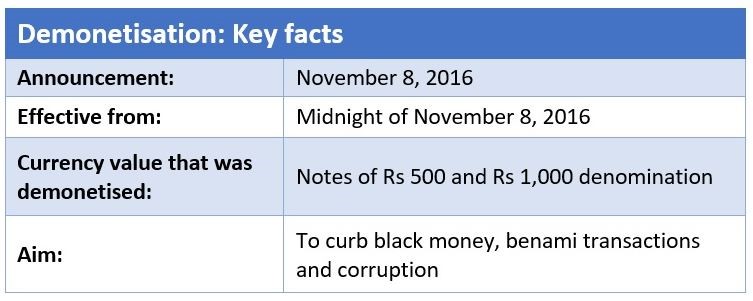

Recently, the Supreme Court upheld the government’s decision to demonetise currency notes of Rs 500 and Rs 1,000 by a 4:1 majority.

Demonetisation is the act of making a currency invalid by stripping off its legal status. To effectuate demonetisation, the existing currency is replaced with new currency.

The Preamble of the Reserve Bank of India Act, 1934, says that the right to regulate the issue of banknotes is entirely with RBI. The RBI generally operates the currency and the credit system.

References