7667766266

enquiry@shankarias.in

Why in news?

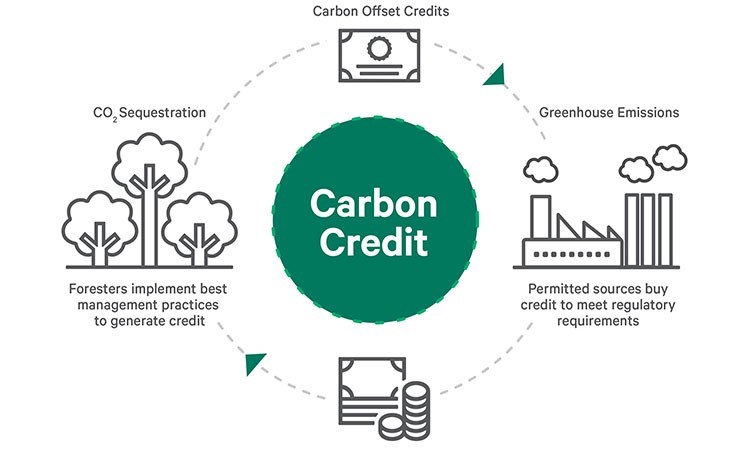

The new rules by United Nations about carbon trading between nations was recently approved at 29th edition of the Conference of the Parties (COP) in Baku, Azerbaijan.

The COP 29 estimated that carbon market could reduce the cost of implementing national climate plans by 250 billion dollar per year by enabling cooperation across borders.

Global carbon trading mechanism could be a reality and that the first UN-sanctioned carbon credits would be available in 2025.

|

Quick facts |

|

India’s carbon trading market

|