7667766266

enquiry@shankarias.in

Why in news?

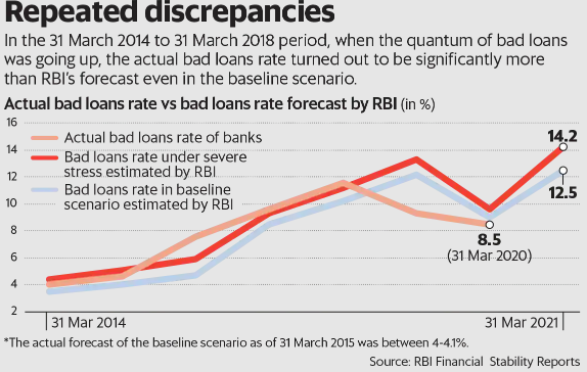

The government has set up the new bad bank structure (NARCL-IDRCL) to acquire stressed assets from banks and then sell them in the market

What are bad banks?

What is the recent new bad bank structure about?

What is the need for bad banks?

Source: The Indian Express