7667766266

enquiry@shankarias.in

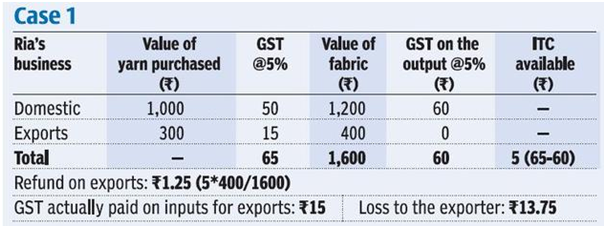

Case - I loss to the exporter

If X purchases and sells goods in the same month

*Assume X is Riain the chart

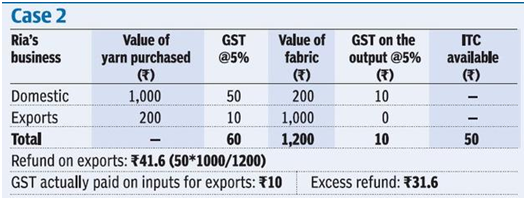

Case – II gain to the exporter

If X buys inputs in a particular month, but sells output in other months.

*Assume X is Ria in the chart

What are the complications in the GST calculation formula?

How this issue can be addressed?

Source: Business line