7667766266

enquiry@shankarias.in

Why in news?

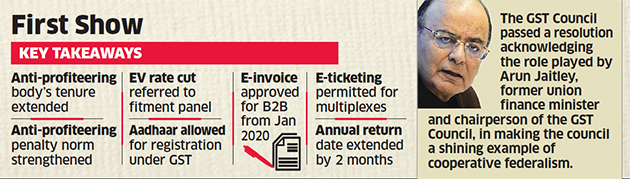

The 35th GST Council meeting (the first to be chaired by the new finance minister Nirmala Sitharaman) was held recently.

What are the highlights?

How effective would NAA tenure extension be?

Source: Economic Times, The Hindu

Quick Facts

GST Council

Goods and Services Tax Appellate Tribunal (GSTAT)

Fitment Committee

Related News: Concerns with Anti-Profiteering Authority