Why in News?

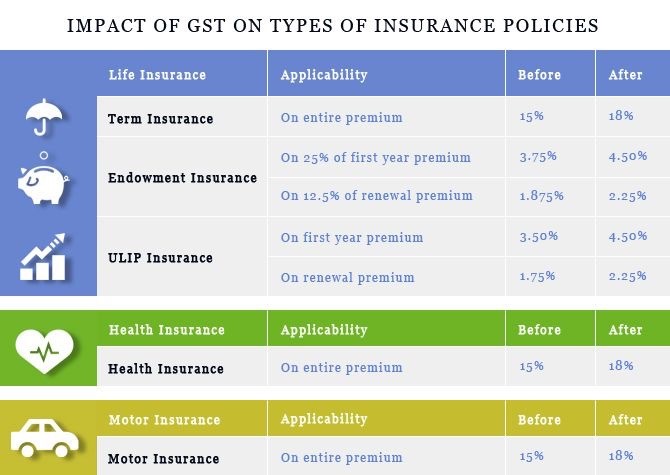

Insurance premiums for health and life policies have increased this year, and with the 18% GST, insurance has become less affordable for many people.

|

Insurance |

|

India is the fifth largest life insurance market in the world's emerging insurance markets, growing at a rate of 32-34% each year. The Insurance Regulatory and Development Authority of India (IRDAI) is the regulatory body that oversees and regulates the insurance sector in India.

|

Aspect |

Argument in support |

Argument against |

|

Rationale for GST imposition |

Recommended by the GST Council, a constitutional body. |

High GST rate of 18% on insurance premiums is the highest in the world and increases the cost for policyholders. |

|

Revenue generation |

GST on insurance generated Rs 21,256 crore in the last three financial years and Rs 3,274 crore from the reissuance of health policies. |

High GST rate leads to high premiums, which can deter people from purchasing insurance policies, thus impacting insurance penetration. |

|

Medical and retail inflation |

The rise in inflation, especially medical inflation, justifies the need for GST to cover increased costs. |

High medical inflation and frequent premium hikes have led to declining policy renewal rates, especially affecting senior citizens and low-income groups. |

|

Tax deductions |

Insurance premiums are eligible for deductions under Sections 80C and 80D of the Income Tax Act, 1961, including the GST component. |

The high GST rate still imposes a significant burden despite tax deductions, making insurance less accessible. |

|

Global comparisons |

Other markets like Singapore and Hong Kong have no GST or VAT on insurance, making it easier to sell insurance without additional tax burdens. |

High GST rates in India need to be rationalized to make insurance more affordable and achieve goals like "Insurance for All by 2047." |

|

Simplification and transparency |

GST replaces multiple indirect taxes, simplifying the tax structure and bringing more transparency. |

Initial confusion and complexity in understanding the new tax regime can burden insurance companies and policyholders. |