7667766266

enquiry@shankarias.in

Click here to understand the basics of GST

Why in news?

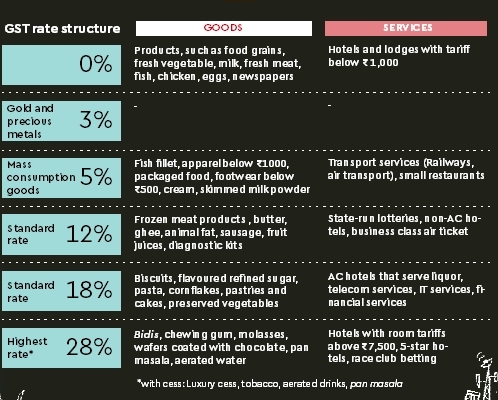

Goods and Services Tax (GST), a historic tax reform, comes into effect today.

What are the basic changes?

What are the advantages?

What are the problems?

What should be done?

Source: The Hindu, The Indian Express