7667766266

enquiry@shankarias.in

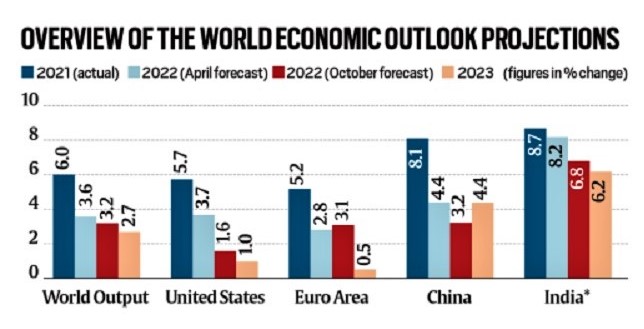

IMF’s latest World Economic Outlook (WEO) has warned that the worst is yet to come for the global economy.

References

Quick facts

Core inflation