7667766266

enquiry@shankarias.in

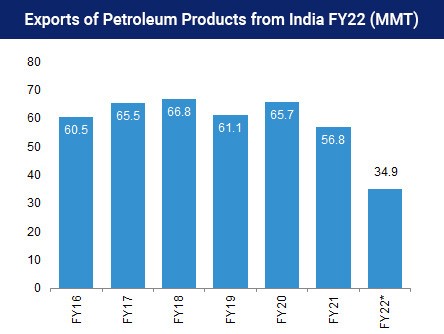

The value of India’s exports in the financial year 2021-22 hit 400 billion dollars which would translate into a growth of about 41% from the pandemic-hit year of 2020-21.

Reasons for achieving the 400 billion dollar exports target

References