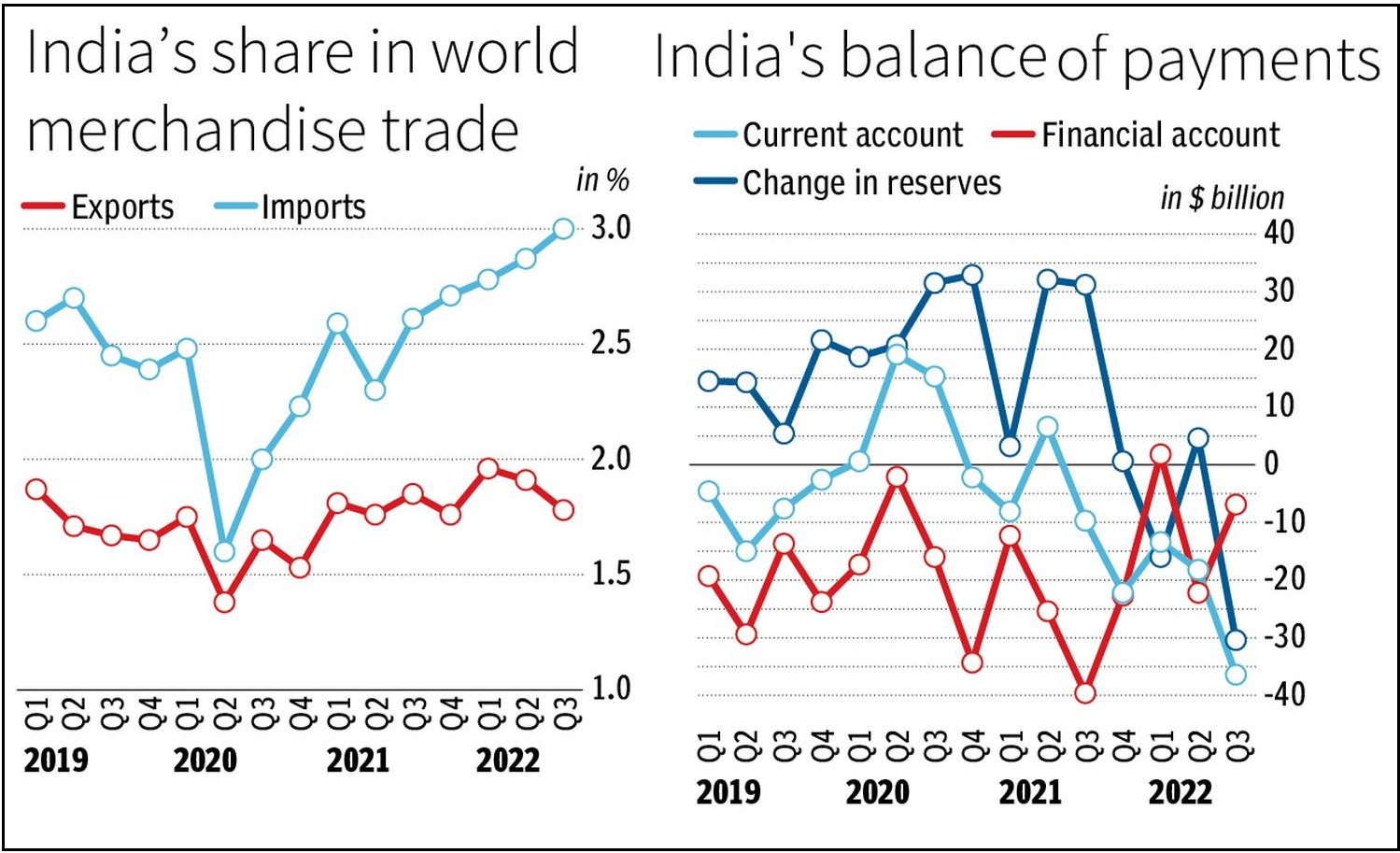

Data released by the government shows that India’s exports and imports declined by 6.59% and 3.63% respectively in January 2023.

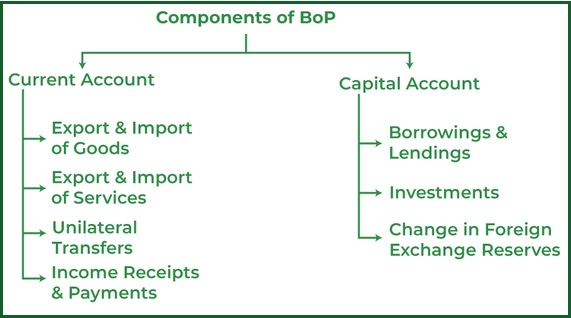

Balance of Payments (BOP)

|

BoP Surplus |

Balanced BoP |

BoP Deficit |

|

Credit Side > Debit Side |

Credit Side = Debit Side |

Credit Side < Debit Side |

Current Account

|

Current Account Surplus |

Balanced Current Account |

Current Account Deficit |

|

Receipts > Payments |

Receipts = Payments |

Receipts < Payments |

A surplus current account - The nation is a lender to other countries

A deficit current account - The nation is a borrower from other countries

|

Trade Surplus |

Balanced BOT |

Trade Deficit |

|

Exports > Imports |

Exports = Imports |

Exports < Imports |

Capital Account

|

Capital Account Surplus |

Capital Current Account |

Capital Account Deficit |

|

Capital inflows > Capital outflows |

Capital inflows = Capital outflows |

Capital inflows < Capital outflows |

A country could use its forex reserves to balance its balance of payments deficit.

The reserve bank sells foreign exchange when there is a deficit. This is called official reserve sale.

The decrease (increase) in official reserves is called the overall balance of payments deficit (surplus).

Quick facts

Reserve assets are financial assets denominated in foreign currencies and held by central banks that are primarily used to balance payments.

References