7667766266

enquiry@shankarias.in

Why in news?

India’s credit rating has recently been upgraded to Baa2 by a global rating agency.

What is a credit rating?

How this rating is calculated?

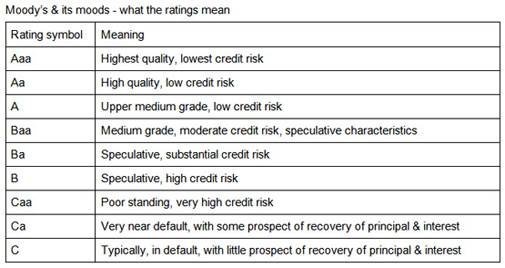

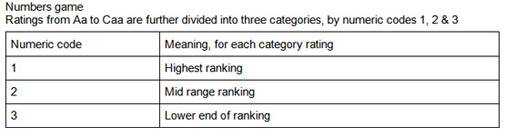

What does the ratings implies?

What is the rating for India?

Source: The Hindu, Business Times