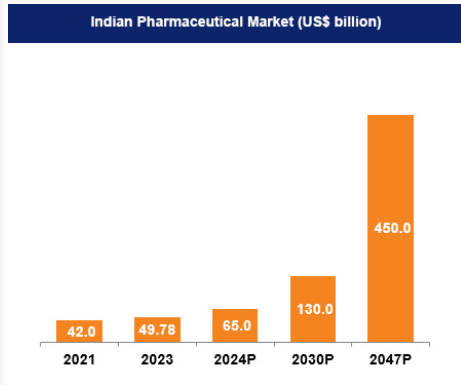

The Indian pharmaceutical sector, currently valued at $55 billion, is expected to reach $130 billion by 2030 and $450 billion by 2047.

WHO sources 65-70% of the vaccine it needs from India.

Patent rights were introduced in India for the first time in 1856 and, in 1970, the Patent Act 1970 (“the Patents Act”) was passed, repealing all previous legislations.

After the WTO Trade-Related Aspects of Intellectual Property Rights (TRIPS), in January 1, 1995, India amended patent laws to introduce product patents for pharmaceuticals, providing 20 years protection to inventions.

In 2001, ISRO facilitated medical consultations between rural hospitals in Andhra Pradesh and Chennai.

In 2023, the telemedicine market in India was valued at $2.5 billion. By 2032, it is expected to reach $16.9 billion, with a compound annual growth rate (CAGR) of 23.88 per cent.

Currently, 7.3 million tourists annually from West Asia, Africa, Southeast Asia.