7667766266

enquiry@shankarias.in

What is the issue?

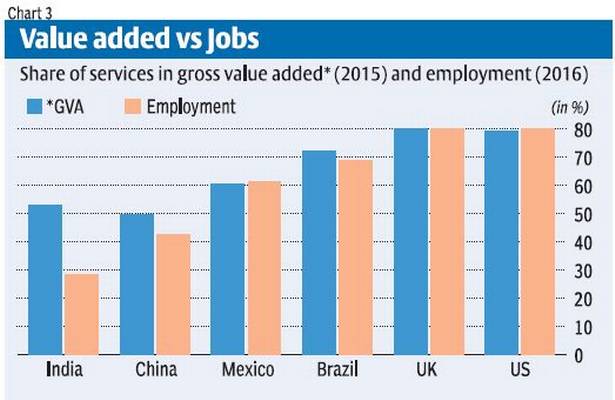

The striking divergence in the services sector’s contribution to GDP and employment growth is bound to have adverse welfare implications.

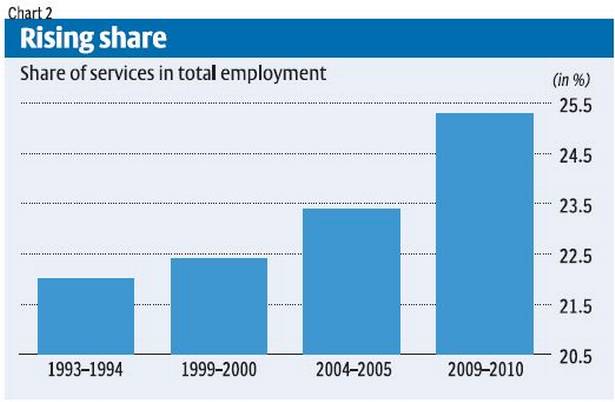

When does the service sector boom started to happen?

What is the contribution of unorganised sector here?

Has the growth ensured adequate employment opportunities?

What are the reasons?

What does these results show?

Source: Business Line