7667766266

enquiry@shankarias.in

From less than 10 MW in 2010, India has added significant photovoltaics capacity over the past decade, achieving over 50 GW by 2022.

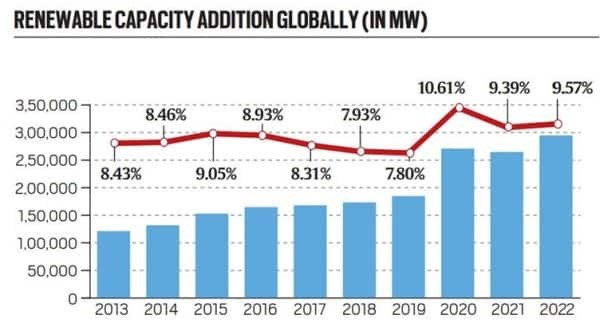

The Indian renewable energy sector is the fourth most attractive renewable energy market in the world with fifth rank in solar power, as of 2020.

More than 90% of the world’s solar wafer manufacturing currently happens in China.

References