India-Israel trade has doubled in the last five years, while the value of India-Iran trade came down in the same period.

|

Key aspects |

India-Israel trade |

India-Iran trade |

|

Trade volume |

A robust growth has been experienced over the past 5 years, doubling from 5.56 billion dollars in 2018-19 to 10.7 billion dollars in 2022-23. |

India's trade with Iran has seen fluctuations in recent years, with bilateral trade reaching 2.33 billion dollars in 2022-23. |

|

Trade components |

Major exports to Israel- Diesel, diamonds, aviation turbine fuel, radar apparatus, Basmati rice, T-shirts, and wheat. |

Major exports to Iran- It is primarily focused on agricultural goods and livestock products. |

|

Major imports to India- Space equipment, diamonds, potassium chloride, mechanical appliances, turbo jets, and printed circuits |

Major imports to India- Methyl alcohol, petroleum bitumen, liquified butanes, apples, liquified propane, dates, and almonds. |

|

|

Trade surplus |

India maintains a significant trade surplus with Israel, with exports outweighing imports, resulting in a surplus of 6.13 billion dollars in India’s favor in 2022-23. |

India also maintains a trade surplus with Iran, with exports exceeding imports by about 1 billion dollars in 2022-23. |

|

FDI |

Israel's FDI in India is relatively low, accounting for just 0.4% of total FDI inflows, while Indian firms have invested more in Israel.

|

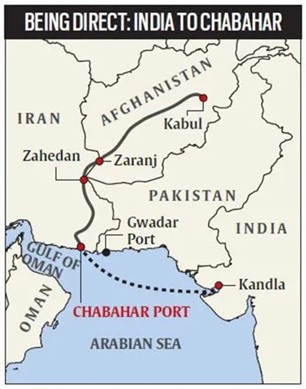

Iran's FDI in India is minimal, recorded at just 1 million dollars, while India is involved in infrastructure development in Iran, particularly the Shahid Beheshti Port at Chabahar. |

To know about Iran-Israel conflict click here

Red Sea is a vital trade route connecting Europe and Asia, with about 12% of global trade passing through it.

|

Middle East-Europe Economic Corridor |

|