7667766266

enquiry@shankarias.in

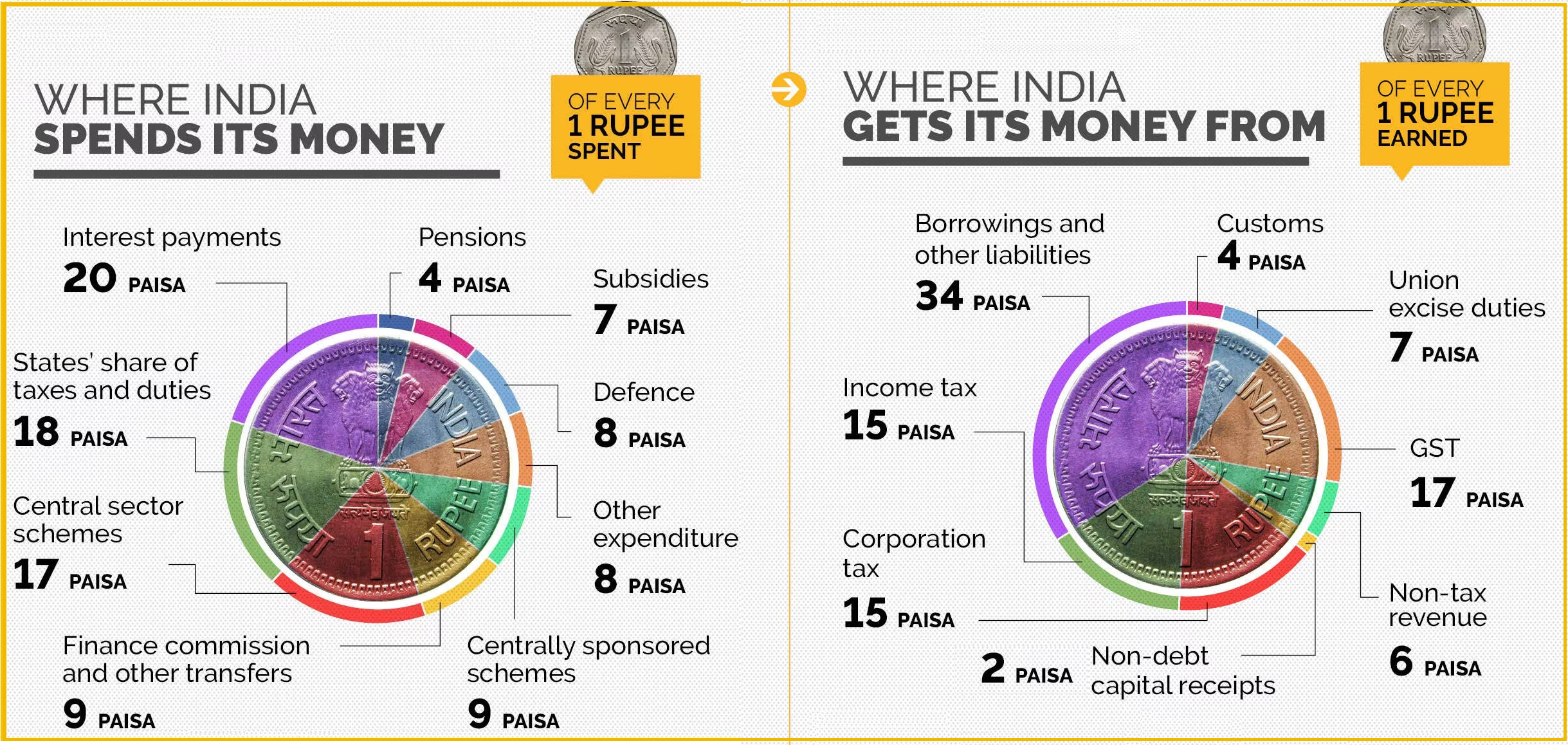

For the third year in a row, interest payments continue to be the single largest component of Centre’s total expenditure.

The Government has announced its commitment to reduce the fiscal deficit to a level below 4.5 % of GDP by FY 2025-26.

Objectives

References