7667766266

enquiry@shankarias.in

What is the issue?

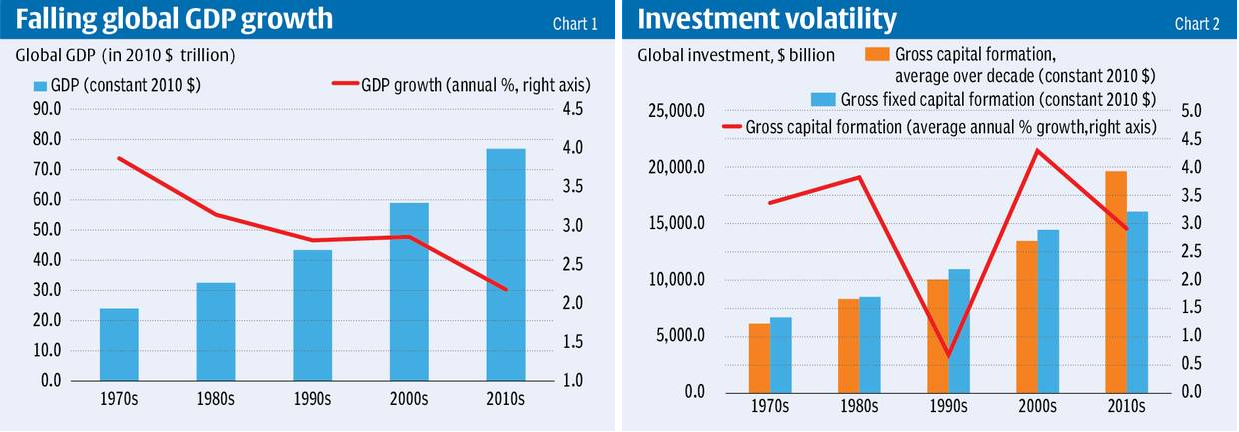

How has capitalism been doing in its “globalised” phase?

How did global capital respond to this immensely supportive configuration?

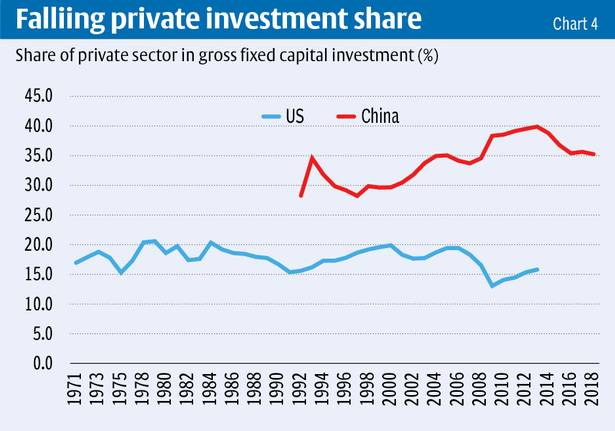

How has East Asia fared?

Is this claim valid?

Source: BusinessLine