7667766266

enquiry@shankarias.in

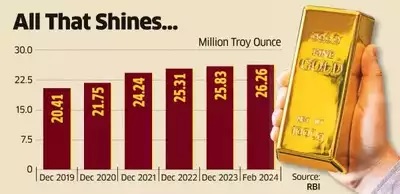

People prefer physical gold over sovereign gold bonds as no trail is left for the tax authorities.

|

About |

A financial instrument introduced by government to reduce gold imports |

|

Launch year |

2016 |

|

Issuer |

Reserve Bank of India (RBI) on behalf of Government of India |

|

Interest |

2.5% paid semi-annually |

|

Eligible investors |

|

|

Investment limit |

|

|

Authorized agencies to sell SGBs |

|

|

Tenure |

8 years with exit option after the 5th year |

Quick facts

|

Electronic Gold Receipts |

|

References