The Reserve Bank of India (RBI) has released its latest Financial Stability Report (FSR) for second half of the year 2021 that details the state of financial stability in the country.

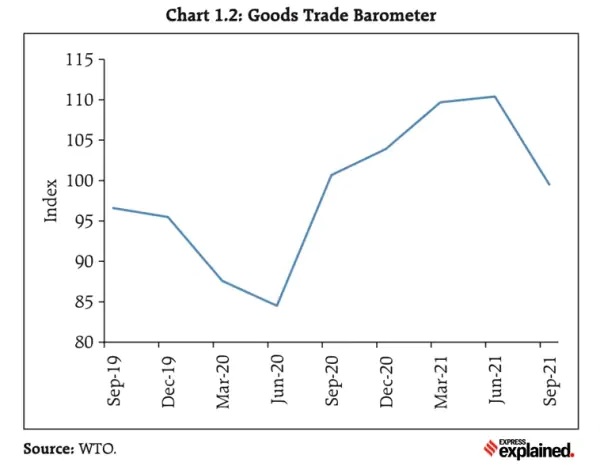

Global growth has started to pause

Disconnect between real economy and India’s equity markets

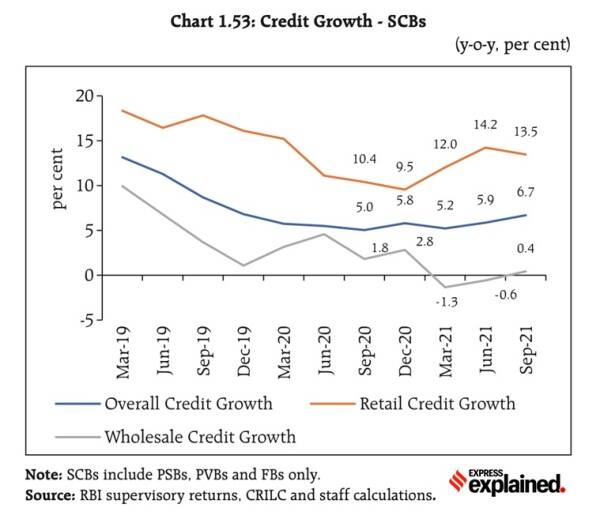

Bank credit growth is improving, but not fast enough

Non Performing Assets (NPAs) may rise by September 2022

Each FSR conducts some “stress tests” to find what will happen to the NPA level if things go wrong. These stress tests are hypothetical adverse economic conditions and are done by taking progressively worse values of variables such as GDP growth, combined fiscal deficit-to-GDP ratio, CPI inflation, weighted average lending rate, exports-to-GDP ratio and current account balance-to- GDP ratio.

Systemic risks evenly balanced

Banking prospects improve

References