7667766266

enquiry@shankarias.in

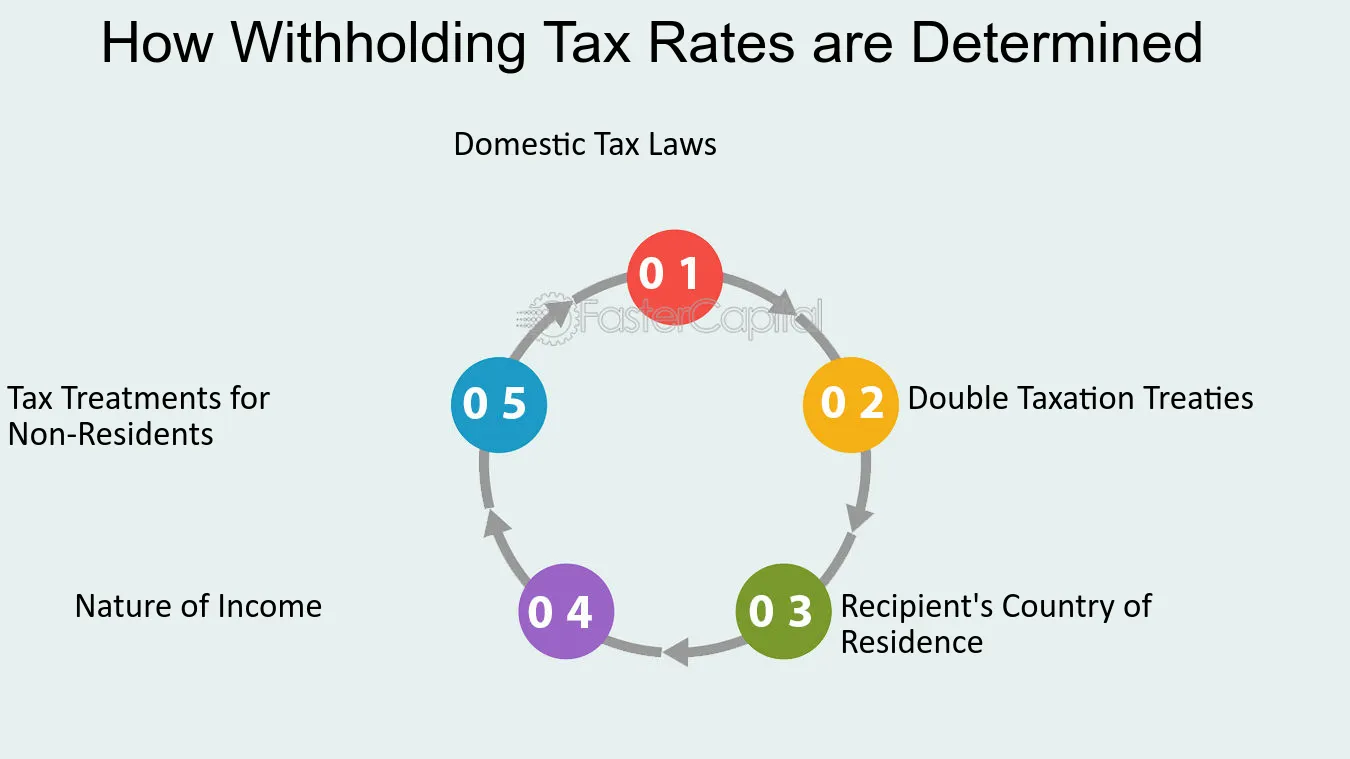

Recently , Switzerland has announced that it will suspend the most favoured nation (MFN) clause in its double taxation avoidance agreement (DTAA) with India, starting from January 1, 2025.