7667766266

enquiry@shankarias.in

Why in news?

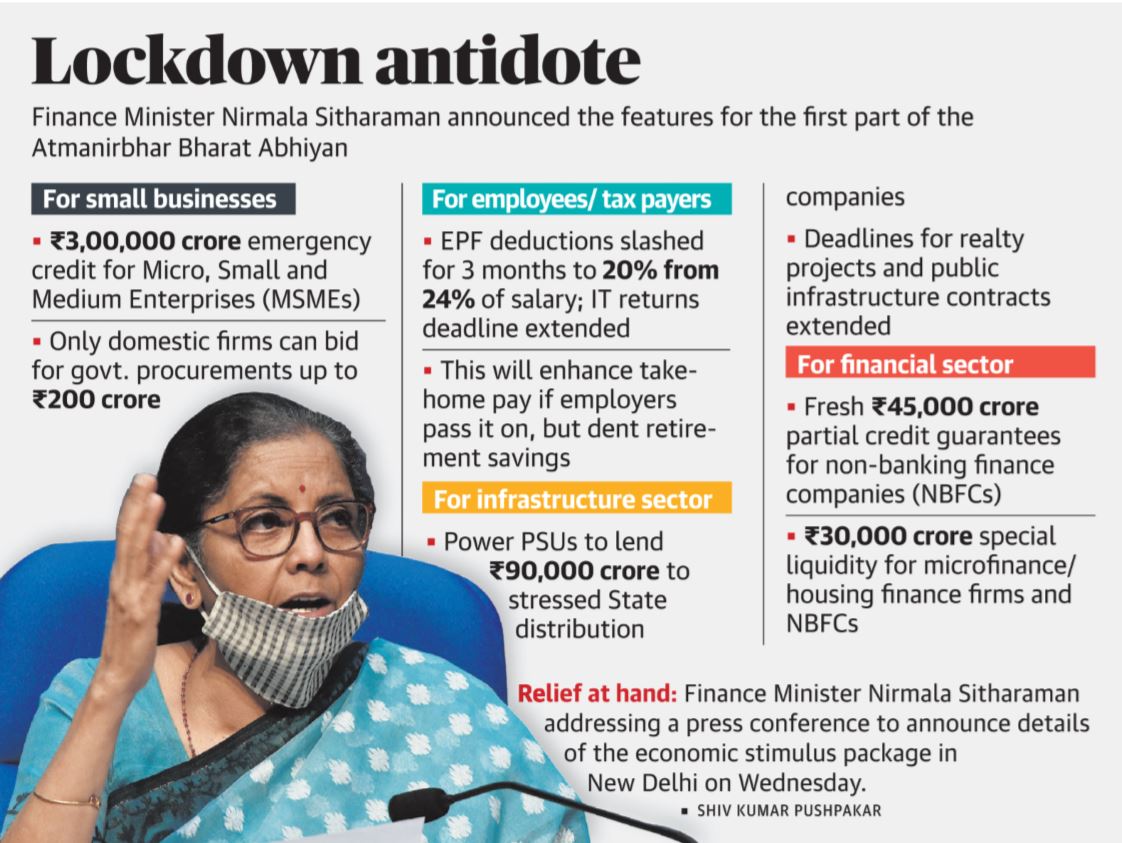

The Minister of Finance made a set of announcements under the Atmanirbhar Bharat Abhiyan (Atmanirbhar meaning self-reliant).

What are the welcome measures?

What are the shortfalls?

What is the overall objective?

Source: The Hindu