7667766266

enquiry@shankarias.in

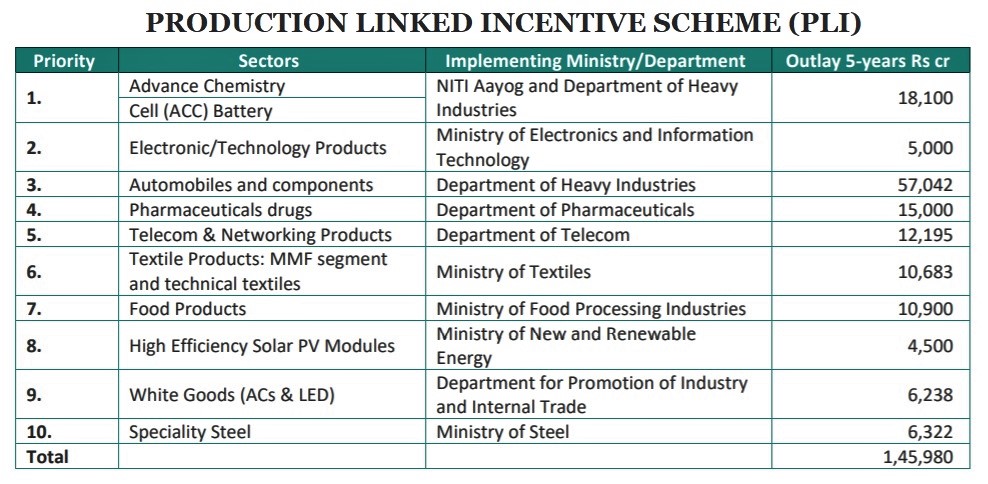

Production Linked Incentive Scheme (PLI) have been floated by the government to encourage capital investment for a higher output but the capital formation rate has moved rather sluggishly.

References