7667766266

enquiry@shankarias.in

Why in news?

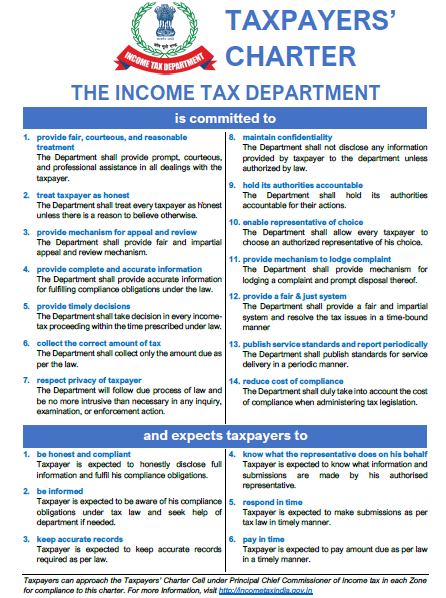

The Centre has launched a platform for faceless assessment and appeals of tax, and a new Taxpayer’s Charter.

What is Taxpayers' Charter?

What is the need for a new charter?

What is a significant part?

How the Centre implements the Charter?

What needs to be done?

Source: Business Line