7667766266

enquiry@shankarias.in

Why in News?

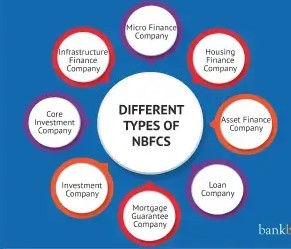

The Reserve Bank of India (RBI) has significantly eased lending restrictions for Non-Banking Finance Companies (NBFCs) recently.

Financial activity as principal business is when a company’s financial assets constitute more than 50% of the total assets and income from financial assets constitute more than 50% of the gross income.

References