7667766266

enquiry@shankarias.in

What is the issue?

In Quantitative easing, the central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment.

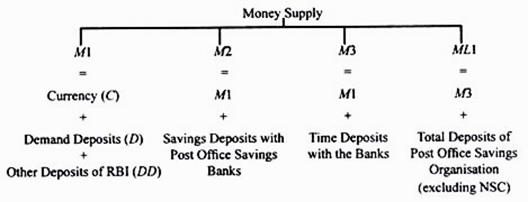

Reserve money = Currency in Circulation + Bankers’ Deposits with RBI + ‘Other’ Deposits with RBI

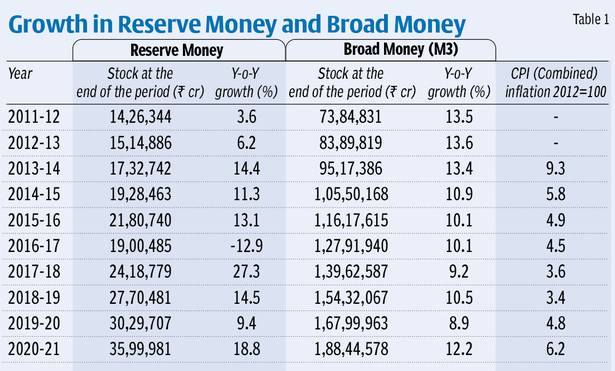

Why inflation targeting has to be looked beyond reserve money growth?

Reference