7667766266

enquiry@shankarias.in

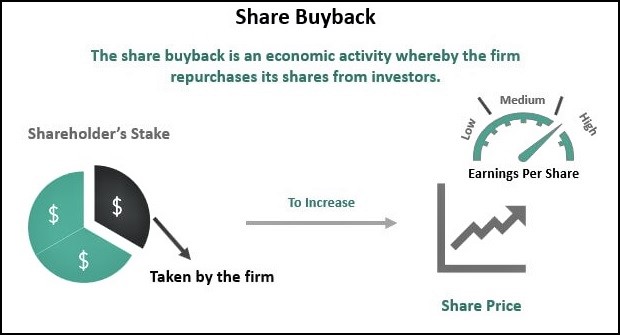

The Securities and Exchange Board of India has decided to phase out the buyback of shares of listed companies through exchange route and favoured the tender offer.

References