7667766266

enquiry@shankarias.in

Why in news?

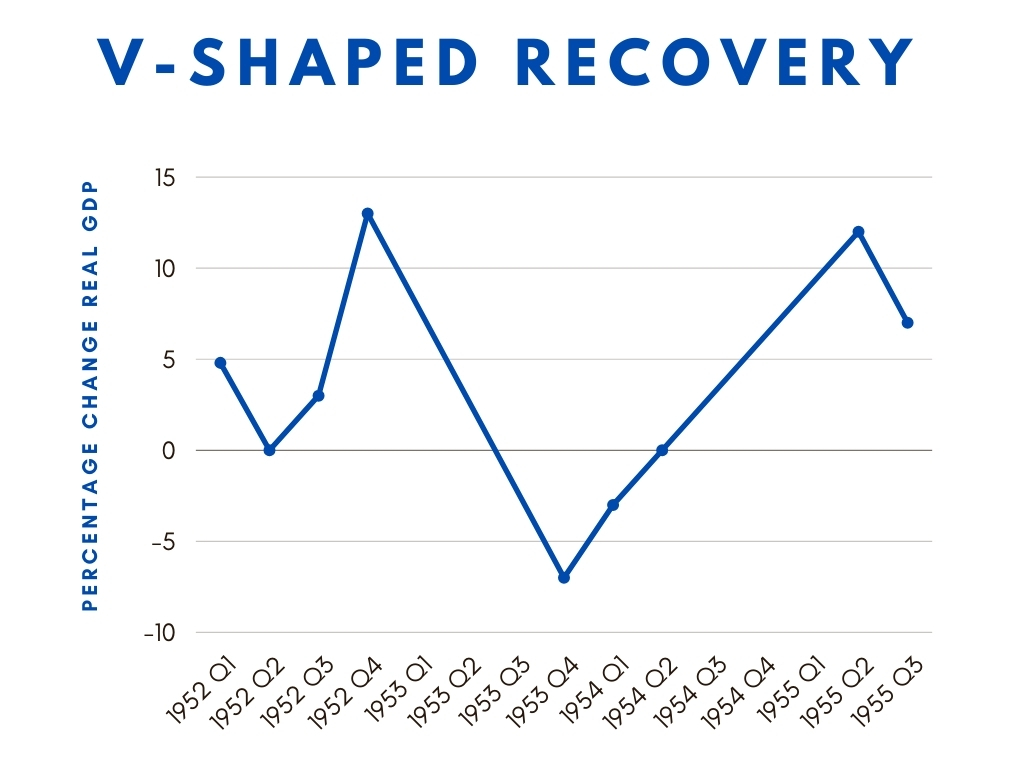

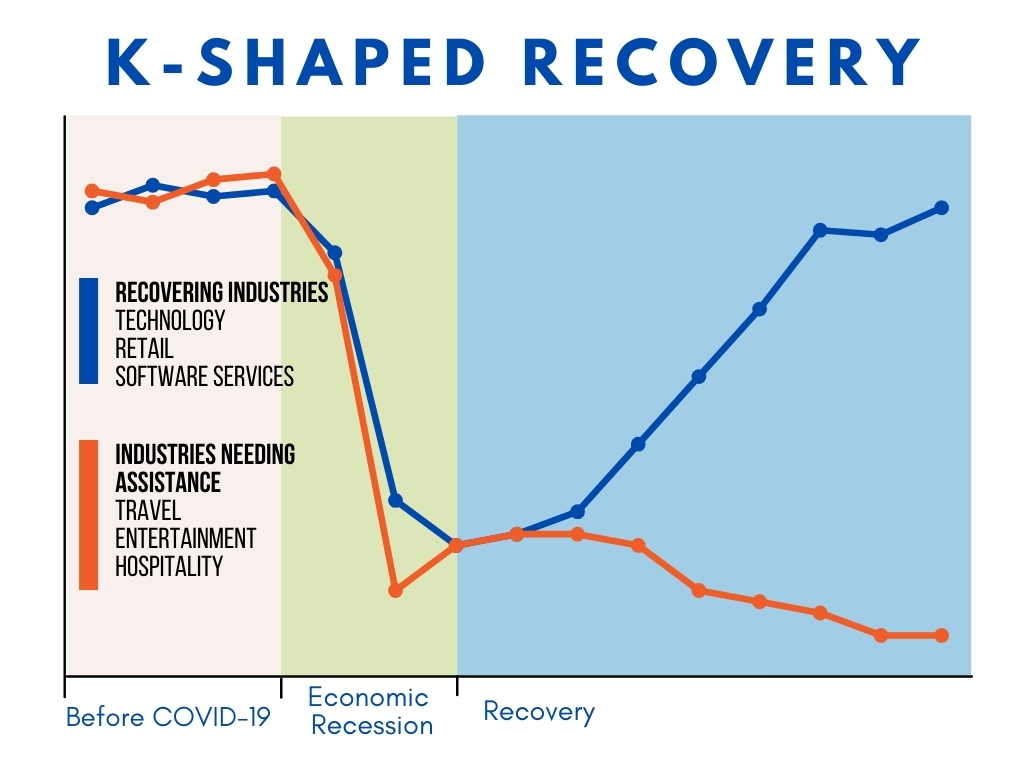

The pointers are indicating that India is witnessing a K shaped recovery more than V-shaped with various groups and industries recovering much more rapidly than their counterparts.

References