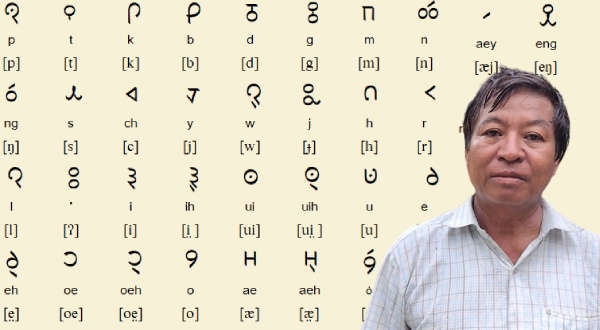

Dhaniram, a Toto (Dengka) language preserver is a recipient of Padma Shri award in the field of Literature & Education.

References

Hydrogen for Heritage

The Union Minister of Railways gave information about “Hydrogen for Heritage” in a written reply to a question in Rajya Sabha.

Field trials of the first prototype on Jind –Sonipat section of Northern Railway is expected to commence in 2023-2024.

References

Adani Enterprises has cancelled its Rs 20,000 crore follow-on public offer (FPO) and will refund proceeds it had received as part of its FPO.

References

The Minister of State for Electronics and Information Technology gave information about Generative AI in a written reply to a question in Rajya Sabha.

References

The Budget 2023 has proposed bringing non-resident investors in unlisted companies under Angel tax regime.

References