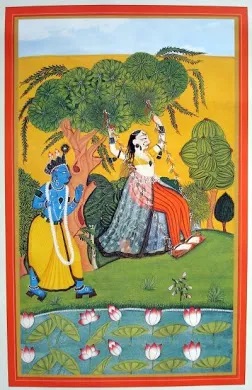

The world famous Basohli Paintings from the Union Territory of Jammu and Kashmir has received the Geographical Indication (GI) Tag.

References

E-Waste (Management) Rules came into force from April, 2023.

References

The International Finance Corporation (IFC) to stop support investments in new coal-powered electricity projects.

India sources about three-fourths of its electricity from coal.

The IFC has reportedly lent close to $5 billion to almost 88 financial institutions in India.

References

Union Budget 2023-24 has announced the setting up of the Urban Infrastructure Development Fund (UIDF)

Rural Infrastructure Development Fund

References

SEBI has approved a framework for Application Supported by Blocked Amount (ASBA)-like facility for trading in the secondary market.

References