7667766266

enquiry@shankarias.in

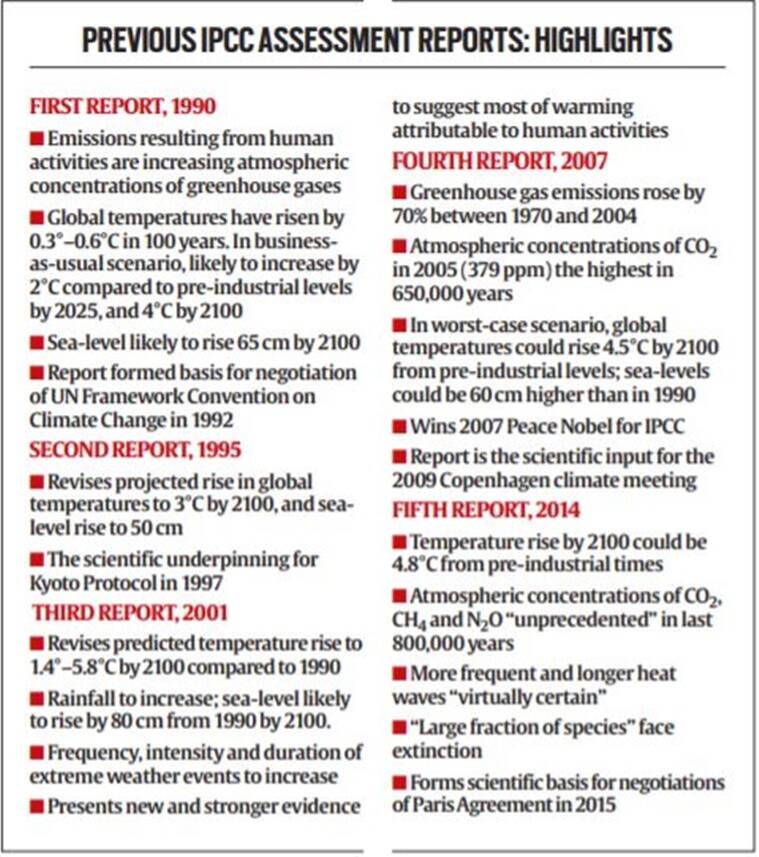

IPCC’s Assessment Report

Pradhan Mantri Suraksha Bima Yojana (PMSBY) - Accidental Death Insurance

The enrolments under PMSBY have gradually increased since its launch in 2015 with cumulative enrolments of 23.88 crore.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) - Life Insurance Cover

Vivad Se Vishwas Scheme

National Policy on Bio-fuels 2018

The Ministry of New and Renewable Energy envisages the creation of a National Biomass Repository through its National Policy on Bio-Fuels 2018.

Source: PIB, The Hindu, The Indian Express