A Polish court in its ruling rejected the primacy of EU law over Polish national legislation in certain matters.

Indian PM recently launched the Indian Space Association (ISpA) - the premier industry association of space and satellite companies.

The current size of the global space economy stands at about USD 360 billion.

India accounts for only about 2% of the space economy with a potential to capture 9% of the global market share by 2030.

136 countries, including India, agreed to enforce a minimum corporate tax rate of 15%, and an equitable system of taxing profits of big companies in markets where they are earned.

The Centre-constituted Commission for Air Quality Management said that there could be reduced stubble burning in the coming seasons due to two main factors.

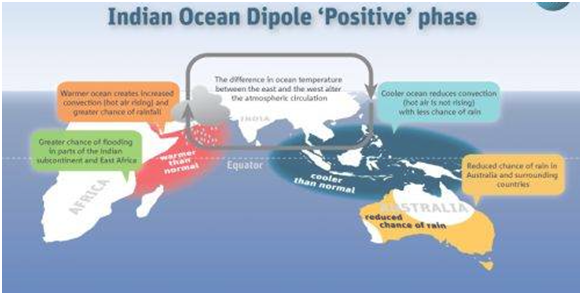

A new study from the University of Hyderabad (UoH) claims to have found out decadal prediction skills for the Indian Ocean Dipole (IOD) to enable monsoon forecast for the next 5-10 years in advance.

Source - The Hindu, The Indian Express, Down To Earth