7667766266

enquiry@shankarias.in

Repo-linked deposit and lending rates

Repo Rate

India’s economic slowdown

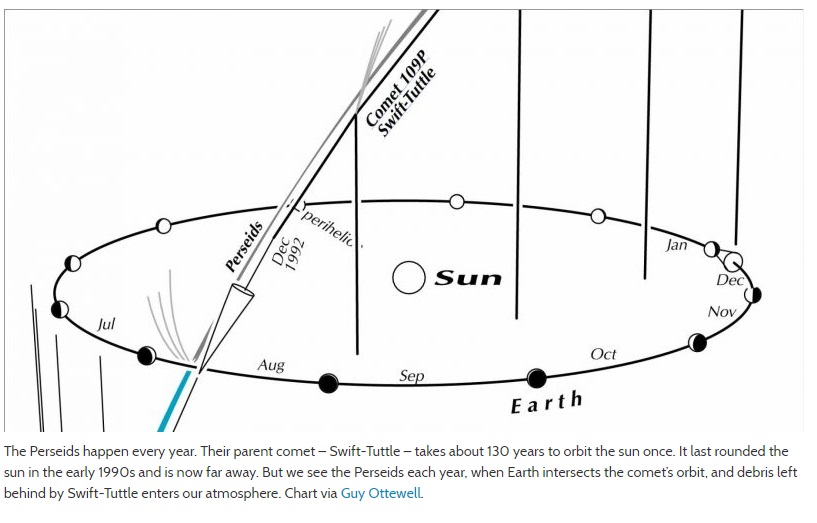

Perseid Meteor Shower

Increase of harmful Mercury level in fish

Source: PIB, The Indian Express