Kollam in Kerala is India’s first Constitution literate district.

References

The Reserve Bank of India (RBI) will auction maiden tranche of sovereign green bonds (SGrB) worth Rs 8,000 crore.

|

Green bonds are bonds issued by any sovereign entity, inter-governmental groups or alliances and corporates with the aim that the proceeds of the bonds are utilised for projects classified as environmentally sustainable. |

A premium refers to a lower yield or lower return, and in turn, higher price on a debt instrument.

Yield is inversely proportional to the bond prices.

References

The Centre has approved Rs. 15,225 crore credit for over 20,000 projects so far, under Agriculture Infra Fund (AIF).

References

Indian Equity market is moving to ‘T+1’ trade settlement cycle from January 27, 2023.

|

Advantages |

Risks |

|

Provides better liquidity to investors and thereby enhance trade and participation. Reduces the overall capital requirements. Boosts operational efficiency as the rolling of funds and stocks will be faster. |

Any downtime for a bank or a large bank could pose a challenge in settling the trades. Higher volatility in capital markets could pose a contagion risk to the ecosystem. |

Securities Exchange Board of India (SEBI) is the apex capital market regulator in India.

|

Year |

Settlement cycle |

|

Before 2002 |

T+5 days |

|

2002 - 2003 |

T+3 days |

|

After 2003 |

T+2 days |

References

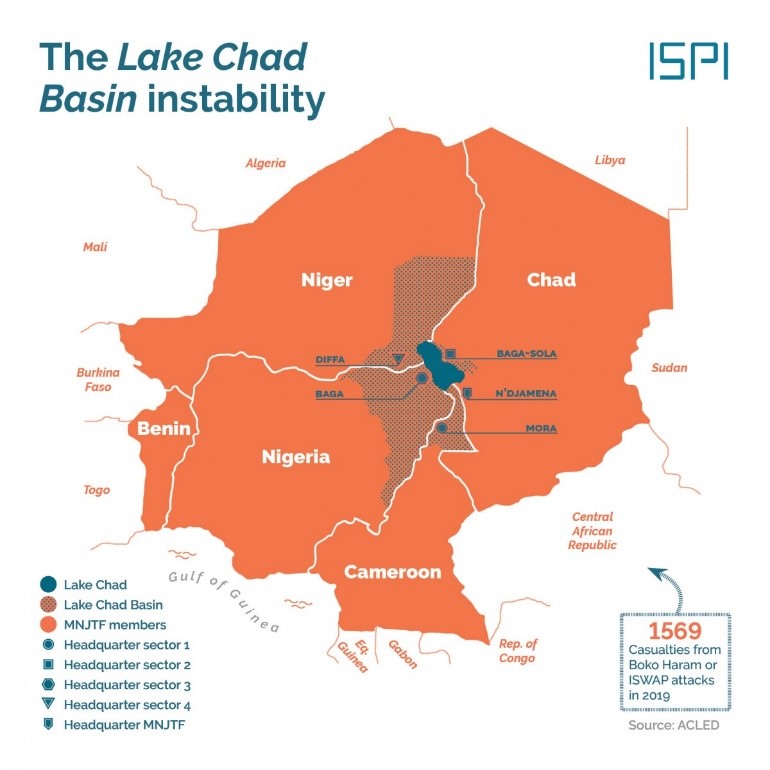

Droughts, flooding and a shrinking Lake Chad is fuelling conflict and migration in the region.

Lake Chad has shrunk 90% in 60 years, which climate change a significant contributor.

References