The NPCI has introduced interchange fees of up to 1.1% on merchant UPI transactions done using prepaid payment instruments (PPI) from April 1, 2023.

A PPI payment via UPI means a transaction done via a wallet, like Paytm Wallet, through a UPI QR code.

Merchant Discount Rate (MDR) is a similar fee charged on merchants but for payments made by users via credit cards.

References

Scientists have reported evidence of the piezoelectric effect in liquids, for the first time.

References

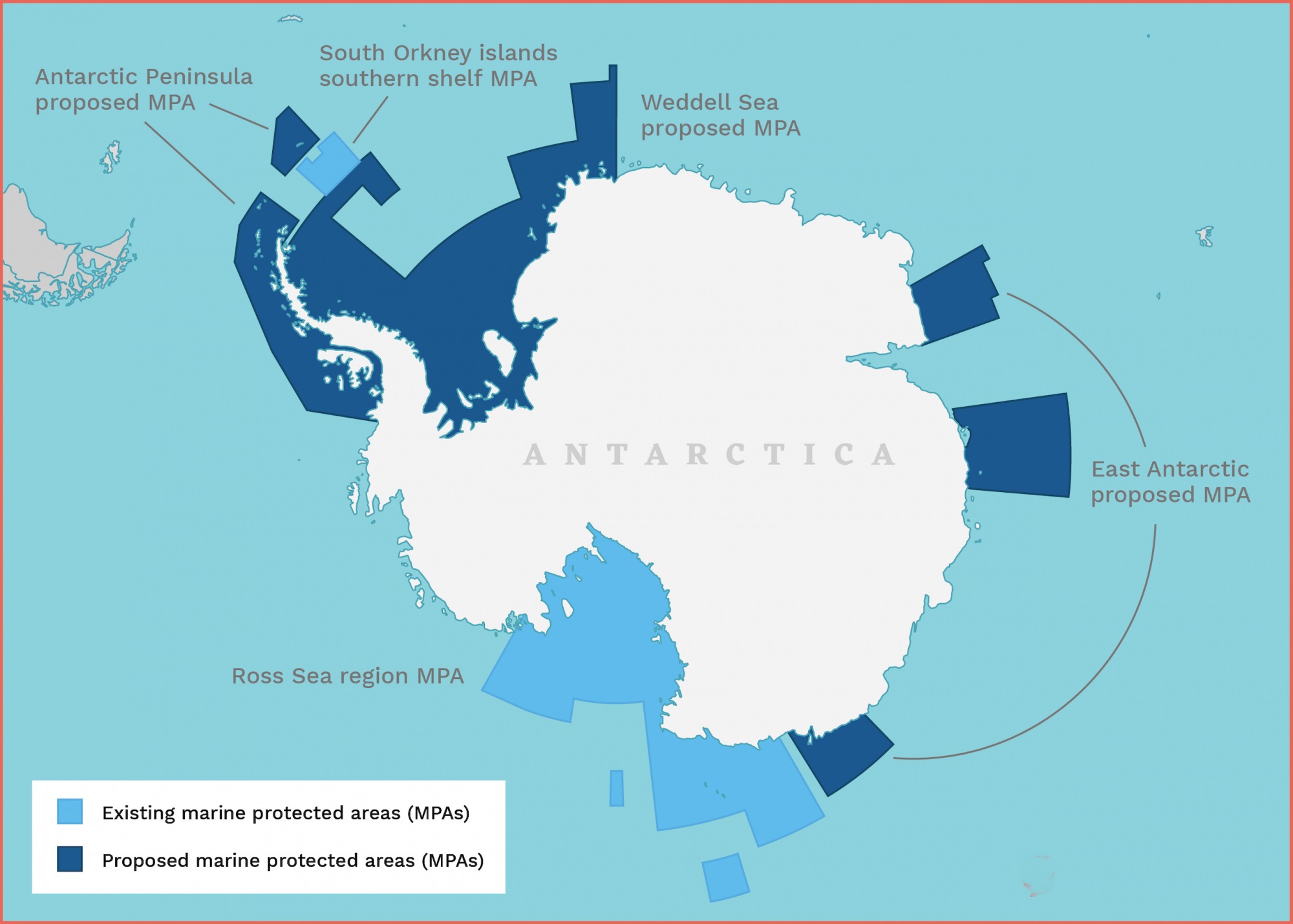

The Union minister of state for science and technology and earth sciences said that India will continue to support setting up 2 MPAs in Antarctica.

References

The Union Minister for Rural Development initiates ‘Captive Employment’ initiative under Deen Dayal Upadhyaya Kaushalya Yojana (DDU-GKY).

References

A Muslim couple from Kerala recently decided to get their marriage registered under the Special Marriage Act (SMA) to ensure their daughter's inheritance.

References