7667766266

enquiry@shankarias.in

Global Soil Biodiversity Atlas

Financial Stability and Development Council

i. the heads of financial sector regulators (RBI, SEBI, PFRDA, and IRDA)

ii. Finance Secretary, Department of Economic Affairs

iii. Secretary, Department of Financial Services

iv. Chief Economic Adviser

v. Chairman of the Insolvency and Bankruptcy Board

i. to perform as an apex level forum to strengthen and institutionalize the mechanism for maintaining financial stability

ii. to enhance inter-regulatory coordination and promote financial sector development in the country

Commercial Paper

Dal-Nageen Lake

Multidimensional Poverty Index

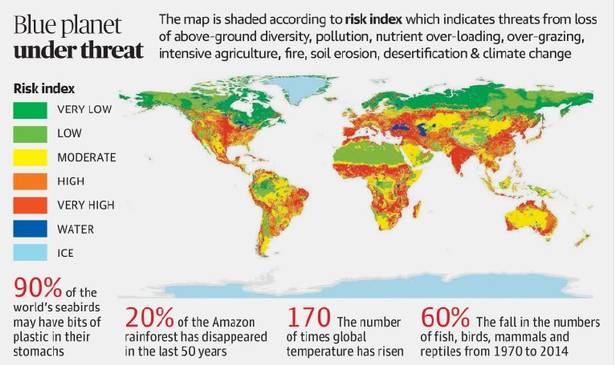

Source: The Hindu