SEBI has directed mutual fund houses to stop accepting any more inflows in schemes that invest in overseas exchange-traded funds (ETFs), starting April 1, 2024.

|

Key aspect |

ETFs |

Mutual Fund |

|

About |

They are passively managed funds that merely replicate an index, these funds usually hold all the stocks in the same weight as they are held by the underlying index. |

It is described as professionally managed investment schemes that collect money from various investors and then invest it in diversified holdings. |

|

Trading and liquidity |

They are traded on the stock exchange like any other stock, making them more liquid. |

They can only be bought or sold at the end of the day at the Net Asset Value price( It indicates one unit of mutual fund) |

|

Flexibility |

It is freely traded in the market and can be bought and sold as per the investor’s convenience. |

It can be bought or sold only by placing a request with the fund house. |

|

Cost structure |

They have lower expense ratios as they merely replicate the performance of the index. |

They have higher management fees as they are managed actively by an experienced fund manager. |

|

Commissions |

They are traded like any other share on the exchange, hence investors need to pay commission on scale and purchase units as per prevailing rules. |

There is no need to pay any commission for the sale and purchase. |

|

Investment approach |

They are passively managed, which means the fund mirrors a particular index, making them less risky and transparent. |

They are actively managed, which means fund managers invest in securities based on their analysis and market outlook. |

|

Minimum investment |

ETFs allow investors to start with smaller amounts. |

Mutual funds typically require a higher minimum investment. |

|

Taxation |

They are more tax-efficient as they have a lower capital gains tax. |

Mutual Funds are less tax-efficient. |

|

Diversification |

ETFs offer more targeted investments that mirror a particular index. |

Mutual funds offer more diversification options and exposure to a broader range of securities. |

|

Types |

There are mainly 5 types: equity ETF, bonds ETF, commodity ETF, international ETF and sectoral/thematic ETF. |

Equity schemes, Debt schemes, hybrid schemes, solution oriented schemes etc.,

|

Reference

Indian Express- SEBI halts overseas ETF

Delhi Chief Minister Aravind Kejriwal was recently arrested by the Enforcement Directorate (ED) in an excise policy case linked money laundering case

References

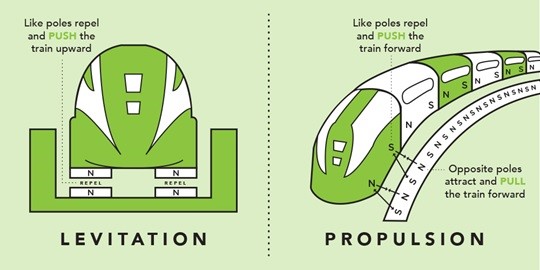

A Switzerland-based hyperloop company Swisspod Technologies signed a memorandum of understanding (MoU) with TuTr Hyperloop, a spin-off of IIT Madras to develop hyperloop systems in India.

|

Hyperloop in India |

|

Reference

Indian Express- Selling point for hyperloop

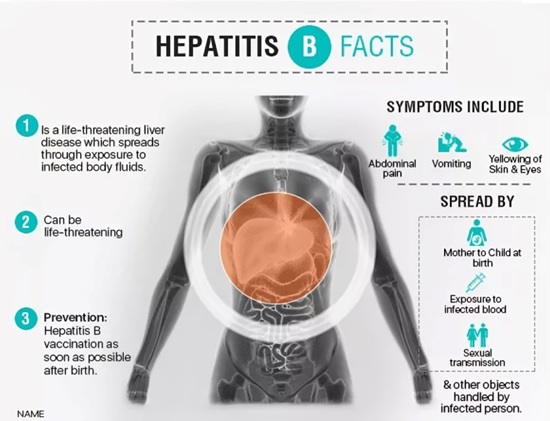

Millions of people living with chronic hepatitis B are unaware they have the virus.

Hepatitis D, also known as “delta hepatitis,” only occurs in people who are also infected with the hepatitis B virus.

References

The Islamic State Khorasan (ISIS-K) has claimed responsibility for the attack at Moscow’s Crocus City Hall which resulted in at least 143 deaths and hundreds injured.

Major high profile attacks

|

Major terror outfits of the world |

Operation base |

|

Al-Qaeda |

It shifted based from Pakistan, Taliban -ruled Afghanistan and later expanded to other parts of the world, primarily in the Middle East and South Asia. |

|

Boko Haram |

It is active in Nigeria, Chad, Niger, Cameroon, and Mali. |

|

Harkat-ul-Mujahideen |

Pakistan and Afghanistan. |

|

Lashkar-e-Taiba |

It is a Pakistan-based group that primarily fights Indian control over Jammu and Kashmir. |

|

Jaish-e-Mohammed |

It is a Pakistan-based terrorist group active in Kashmir. |

|

Islamic State of Iraq and Levant (ISIL) |

It operates mainly in western Iraq and eastern Syria. |

References