7667766266

enquiry@shankarias.in

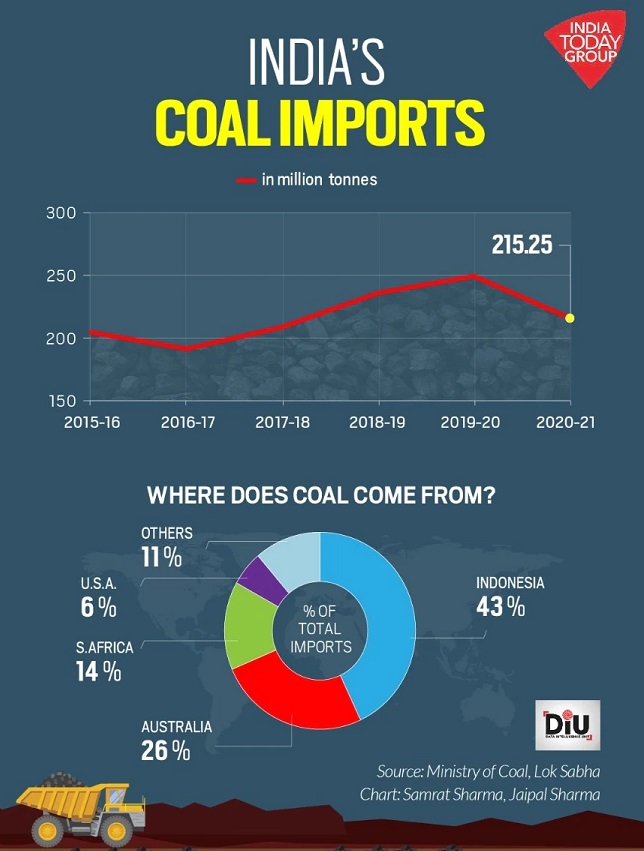

With a coal-supply demand gap, and international coal prices rising, cash-strapped thermal power generators are left with critical stocks.

About 79 of the 150 plants that depend on domestic coal had critical stocks (<25% of the required stock) as of June 15. Eight import-based coal plants were also at critical levels.

According to the 2019-20 report by the Power Finance Corporation, discoms had accumulated losses up to Rs. 5.07 lakh crore and were unable to pay generators on time.

References