7667766266

enquiry@shankarias.in

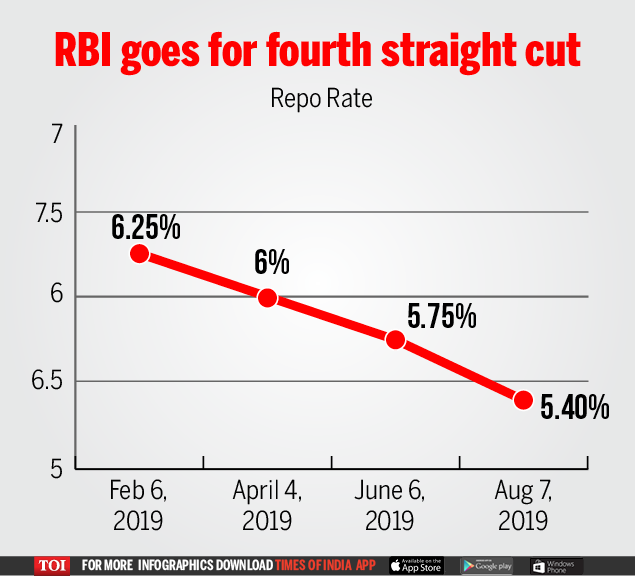

Why in news?

What is the repo rate?

What is the rationale?

What were the RBI’s observations?

Why is the GDP growth revision now?

How does the future look?

What is the way forward?

Source: Indian Express, The Hindu