7667766266

enquiry@shankarias.in

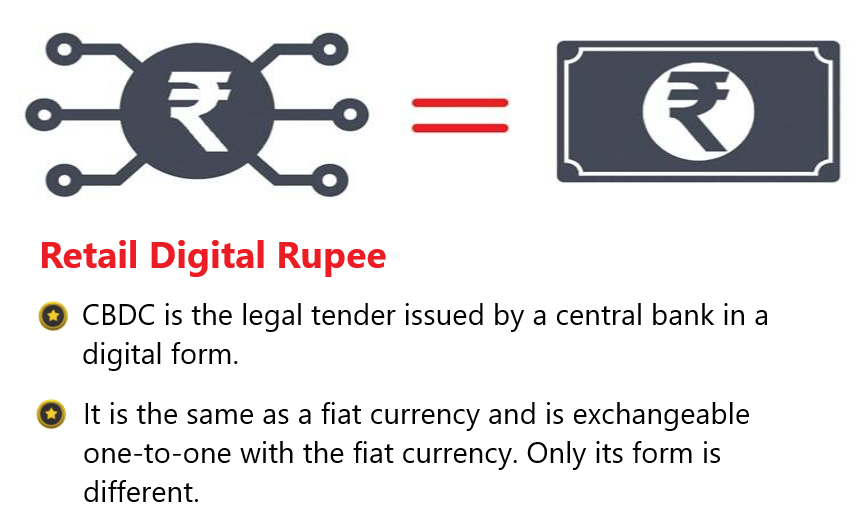

The Reserve Bank of India has recently launched the e-Rupee for retail users.

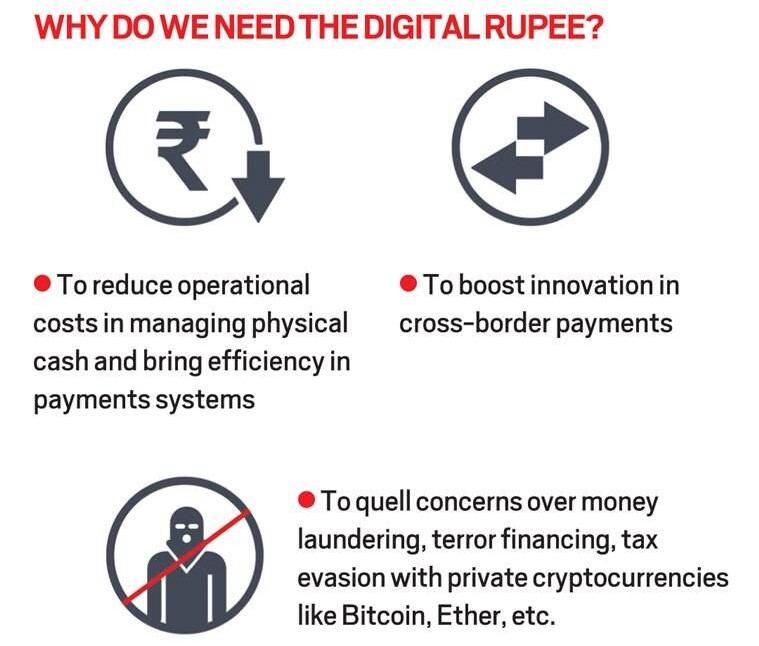

CBDC has the potential to provide significant benefits such as:

Other benefits

Reference