7667766266

enquiry@shankarias.in

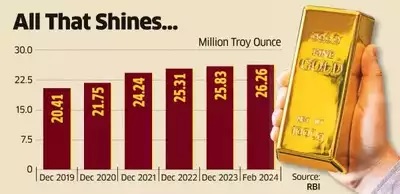

RBI has increased gold purchases to diversify reserves, with gold value contributing to a 3 billion dollars rise in forex reserves to 648.5 billion dollars.

The RBI's gold reserves are typically valued based on prices quoted on the London Bullion Market Association (LBMA), one of the world's leading precious metals markets.

RBI aims to diversify its reserves with gold accounting for about 8.41% of total foreign exchange reserves in value as of early April 2024.

|

Foreign Exchange Reserve |

|

|

Bank of International Settlements (BIS) |

|