7667766266

enquiry@shankarias.in

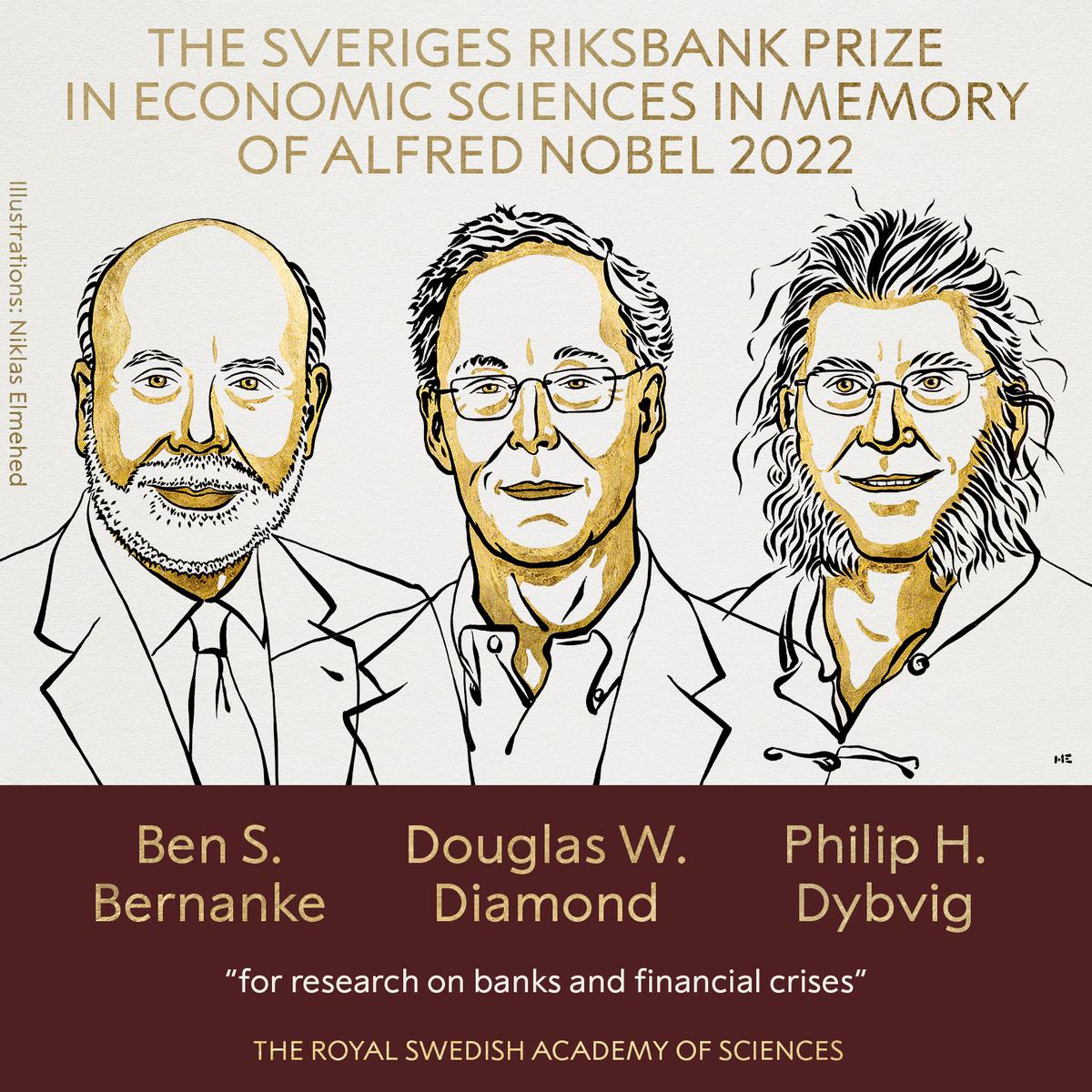

At a time when the World Bank and the International Monetary Fund have warned of a possible global recession in 2023, the 2022 Nobel Economics Prize has shed light on the role of banks in saving the economy.

Supporting evidences

References

Quick facts

Sveriges Riksbank Prize in Economic Sciences

Keynesian economics

Central bank discount window