7667766266

enquiry@shankarias.in

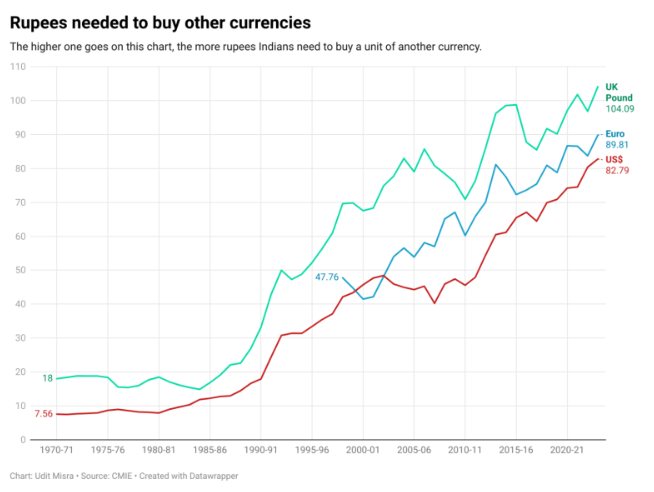

The Indian rupee’s exchange rate against the US dollar has breached the 85 mark.

The biggest FEM centre is London.

Society of Worldwide International Financial Telecommunications (SWIFT) is a satellite-based communications network to facilitate forex market messaging services.

Foreign Exchange Dealers Association of India (FEDAI) was set up in 1958 as an Association of banks dealing in foreign exchange in India (typically called Authorised Dealers - ADs) as a self-regulatory body.

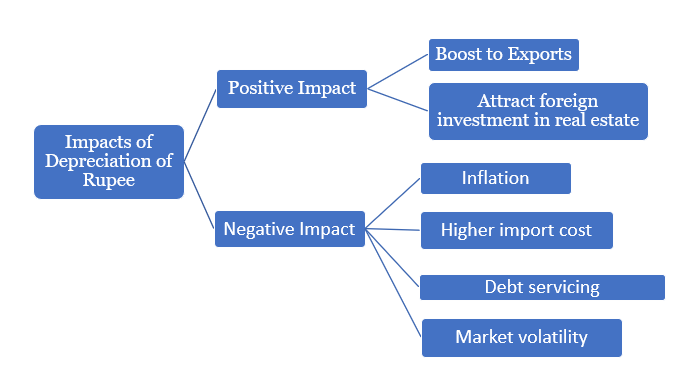

What can be done to improve the Rupee value?