7667766266

enquiry@shankarias.in

What is the issue?

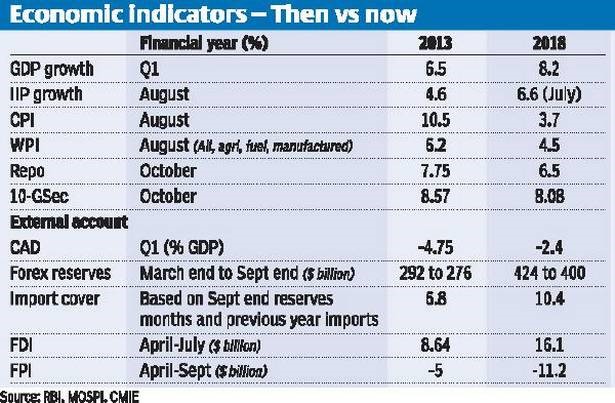

The rupee’s relentless slide in recent weeks has led to comparisons with the situation that prevailed in 2013.

What was the 2013 episode?

How does India stand today?

What are the concerns?

What should be done?

Source: Business Line