7667766266

enquiry@shankarias.in

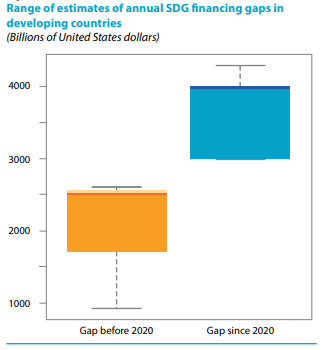

In the recently held ‘Voice of Global South Summit’, Union Finance Minister raised the issue of the SDG-financing gap faced by developing countries.

According to the International Monetary Fund’s report, India’s investment needs to meet its climate-change adaptation, and mitigation targets are sizable, estimated at 4-8% of gross domestic product per year.

In the 4th edition of SDG India Index by Niti Aayog, India had made progress, obtaining a score of 71 in 2023-24, up from 66 in 2020-21 and 57 in 2018.

References