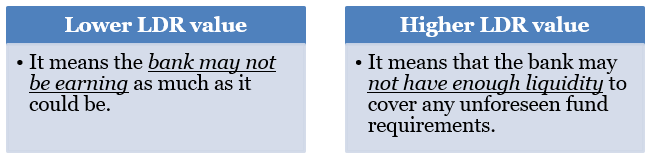

Latest data from the Reserve Bank of India (RBI) showed that deposits grew at a lower rate than the bank credit growth rate signifying higher loan-deposit ratio.

Deposits refers to which the customers keep with the bank and get interest for. Credit refers to which the bank lends to customers at an interest rate charged from them.

What is the role of capital market in reducing bank deposits?

While bank deposits continue to remain dominant as a percentage of financial assets owned by households, their share has been declining with households increasingly allocating their savings to mutual funds, insurance funds and pension funds.

National Securities Depository Ltd (NSDL) is an Indian central securities depository, based in Mumbai. It was established in August 1996 as the first electronic securities depository in India.

Central Depository Services Ltd (CDSL) is the second Indian central securities depository based in Mumbai. It is the largest depository in India in terms of number of demat accounts opened.