7667766266

enquiry@shankarias.in

What is the issue?

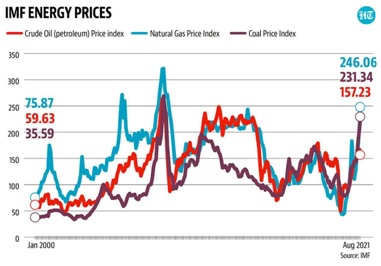

The recent spike in global crude oil prices above the $80-per-barrel mark led to a dip in key indices in the stock market.

Why are oil prices rising?

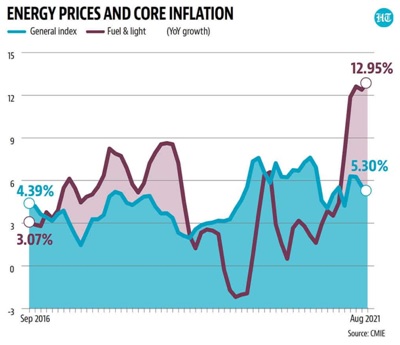

What will be the impact of rising oil prices?

Crude import accounts for nearly 20% of India’s import bill.

It also impacts the current account deficit — a measure of value of imported goods and services exceeding the value of those exported.

Source - The Indian Express