7667766266

enquiry@shankarias.in

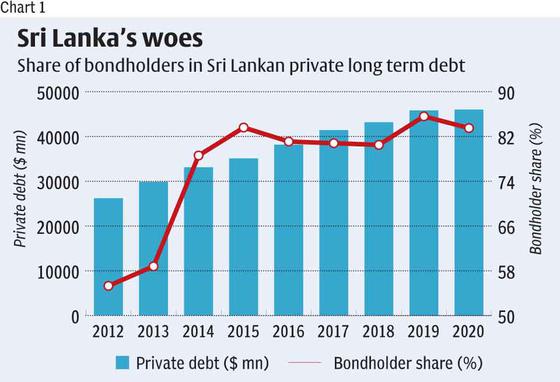

Sri Lanka has reached a staff-level agreement (formal arrangement) with the IMF that promises access to 29 billion dollar over a 4-year period.

References