7667766266

enquiry@shankarias.in

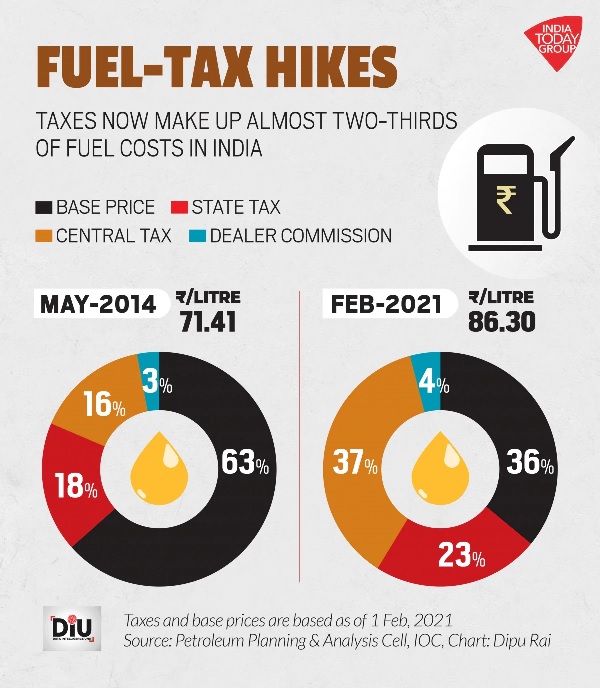

The Centre and the states are at loggerheads over taxes and duties on petrol and diesel.

Value-added tax (VAT) is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added, from initial production to the point of sale.

The tax on fuel does not fall under the Goods and Services Tax (GST).

The Latin phrase ad valorem means "according to value." All ad valorem taxes are based on the assessed value of the item being taxed.

References