7667766266

enquiry@shankarias.in

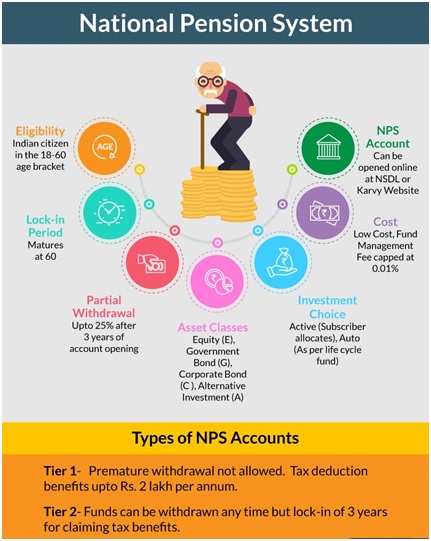

Staying with the Time-tested NPS System

The Rajasthan government’s Budget proposal to revert all its employees to the old pension system represents the reversal of a very significant reform.

The EPFO is a social security organisation which functions under the Employees' Provident Funds Act, 1952 to extend universal coverage and ensure Nirbadh (seamless and uninterrupted) service delivery to its stakeholders.

India is expected to see a 41% spike in its elderly population in the next decade with its old age dependency ratio likely to rise from 15.7% to 20%.

PFRDA, the authority established through the PFRDA Act, 2013 is ensuring the orderly growth and development of pension market.

References